Strategy/Objective setting: Consider Tesla, a publicly-traded company operating in two primary segments – automotive and energy generation.Communication and monitoring: Relevant information and data need to be constantly monitored and communicated across all departmental levels.Įxample of an Enterprise Risk Management Process.Risk response: Consider various risk response strategies and select appropriate actionable paths to align identified risks with management’s risk tolerances.Risk assessment: Identified risks are strictly analyzed to determine both their likelihood and potential.Risk identification: Provide a clear profile of major risks that can negatively impact the company’s overall financials.Strategy/Objective setting: Understand the strategies and associated risks of the business.The process includes five specific elements:

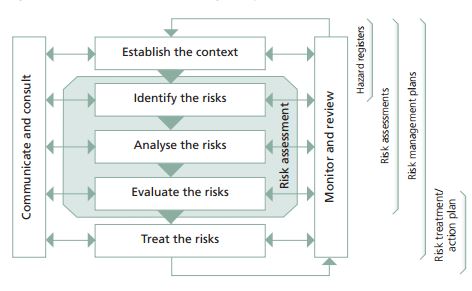

For example, management can plan frequent visits to their major suppliers to identify potential problems early. Risk reduction: The mitigation or limitation of the severity of losses.For example, the cancellation or halt of a proposed production or product line. Risk avoidance: The elimination of risks or activities that can negatively impact the organization’s assets.Management selects one of the five appropriate risk response strategies below to deal with their identified risks: Risk Response Strategies for Enterprise Risk Management Operational risks are risks that materially affect an organization.Strategic risks are risks that affect or are created by strategic business decisions.They include financial consequences like an increase in costs or a decline in revenues. Financial risks refer to risks that are directly related to money.Hazard risks include risks that present a high level of threat to life, health, or property.They found that 61% of occurrences were due to strategic risks, 30% were operational risks, and 9% were financial risks. In 2004, the JLA research team analyzed 76 S&P 500 companies on their risk types, where there was a 30% or higher decline in market value. The ERM process includes five specific elements – strategy/objective setting, risk identification, risk assessment, risk response, and communication/monitoring.There are four specific types of risks associated with each business – hazard risks, financial risks, operational risks, and strategic risks.An effective risk management method, if integrated properly, can result in substantial cost savings for the company. Enterprise Risk Management (ERM) is essential for public and private companies to approach risk management with confidence.

0 kommentar(er)

0 kommentar(er)